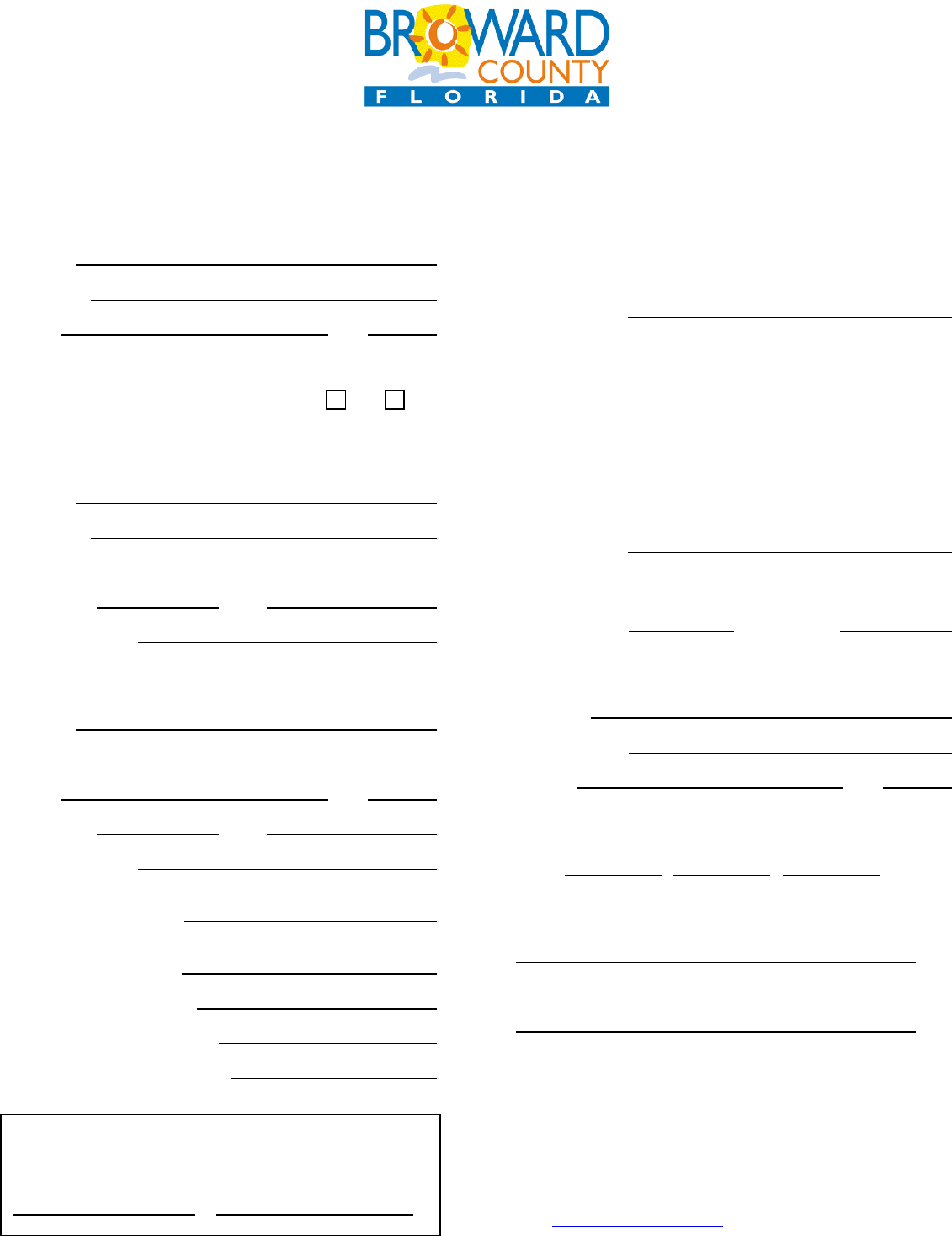

Board of County Commissioners, Broward County, Florida

Finance and Administrative Services Department

Records, Taxes and Treasury Division - Tourist Development Tax Section

REGISTRATION FORM

1. RENTA

L PROPERTY INFORMATION:

Name:

Address:

City: State:

Zip Code: Phone:

Is this property leased from another party? Yes No

2. OWNER INF

ORMATION:

Name:

Address:

City: State:

Zip Code: Phone:

E-Mail Address:

3. DEALER /

LESSEE INFORMATION:

Name:

Address:

City: State:

Zip Code: Phone:

E-Mail Address:

4. RENTAL START DATE:

5. FED. TAX ID NUMBER:

SALES TAX / CERT. NO.:

FDOR FILING FREQUENCY:

LOCAL BUS. TAX ACCT. NO.:

6. TYPE O

F BUSINESS:

____Corporation ____Individual

____Partnership ____Limited Liability Co.

____Other:

7. TYPE

OF RENTAL:

____Apartment ____Boar

ding Room

____Campground ____Condominium

____Hotel/Motel ____Multi-Family Home

____RV / Mobile Home Park ____Time Share

____Real Estate/Property Manager

____Single Family Home

____Other:

8. NUMBE

R OF:

Total Units: Transient Units:

9. BANK INF

ORMATION:

Name:

Account No:

City: State:

10. SELE

CT MAILING ADDRESS:

1. 2. 3.

11. APPL

ICANT:

Name (print) Title

Signature Date

RETURN TO:

Tourist Development Tax Section

Records, Taxes and Treasury Division

115 S. Andrews Avenue, Room A-110

Fort Lauderdale, FL 33301

Office: 954-357-8455 Fax: 954-357-6524

touristax@broward.org

OFFICIAL USE ONLY:

COUNTY A

CCOUNT NO: FOLIO NO:

401-210

Board of County Commissioners, Broward County, Florida

Finance and Administrative Services Department

Records, Taxes and Treasury Division - Tourist Development Tax Section

REGISTRATION FORM

401-210

INSTRUCTIONS

1. RENTAL PROPERTY INFORMATION:

Enter trade, fictitious (d/b/a), or location (i.e. hotel, motel, apartment building, condominium complex) name. Enter the

actual physical (street) address of the rental property. A post office box is not an acceptable address. Indicate by placing

a check mark on the appropriate line if this property is rented from another party. Agents (such as representatives, property

managers or management companies) filing tax returns which report transient rental revenue from separately owned

properties under a single account must attach a schedule indicating the property owner and property address.

2. OWNER INFORMATION:

Enter the rental property owner’s name (i.e., individual, partner, corporate, etc.,) address, telephone number, and E-Mail

address.

3. DEALER / LESSEE INFORMATION:

If applicable, enter the dealer’s name (i.e., operator, property manager, etc.) or lessee’s name, address, telephone number

and E-Mail address. The dealer’s information relates to individuals or entities designated by the owner to be responsible

for the business aspects of the rental property. The lessee’s information relates to individuals or entities that do not own

the rental property but hold a lease from the property owner.

4. RENTAL START DATE:

Enter the date this business or individual became or will become liable for Broward County Tourist Development Tax.

5. Enter your Federal Tax ID number.

Enter your Florida Department of Revenue (FDOR) Sales Tax / Certificate Number.

Enter your Florida Department of Revenue Filing Frequency (i.e. Monthly, Quarterly, Semi-Annual or Annual).

FDOR Coral Springs Taxpayer Service Center Phone: 954-346-3000

Enter your Broward County Local Business Tax Account Number.

Broward County Local Business Tax Phone: 954-831-4000

6. TYPE OF BUSINESS:

Place a check mark on the appropriate line. If “Other”, please state the type in the space provided.

7. TYPE OF RENTAL:

Place a check mark on the appropriate line. If “Other”, please state the type in the space provided.

8. NUMBER OF UNITS:

Indicate the number of total units and transient rental units located at the rental property address.

9. BANK INFORMATION:

Enter the name of the bank, account number, city and state where the business bank account is located.

10. SELECT MAILING ADDRESS:

Place a check mark on the line indicating the mailing address for tax returns and official correspondence.

One (1) is the Rental Address, Two (2) is the Owner Address and Three (3) is the Dealer or Lessee Address.

11. APPLICANT:

Enter the authorized person’s printed name and title.

All forms must contain the authorized person’s signature and date.

Website: broward.org/recordstaxestreasury