3

Table of Contents

4 Greetings from the Chairman of the Board and the Chief Executive Ocer

7 Business Planning

8 Strategic Priorities

11 Marketing & Business Development Review

11 Air Service

13 Marketing

14 Operational Review

15 Financial Review

16 Human Resources

17 Community Relations

19 Governance

22 Financial Statements

4 Charlottetown Airport | 2014 Annual Report

Chairman of the Board Letter

As I draft this letter it’s late March and we are

enduring yet another winter storm. Provincial plows

have been taken o the roads because of poor

visibility and there are reports of major road routes

that are impassable.

Whatever the means of transportation, it has been

a tough winter for scheduling and maintenance.

The sta at Charlottetown Airport and our terminal

partners are to be commended for the herculean

eort given to accommodate air travellers and to

keep flights and passenger trac flow moving.

Thank you.

We set snowfall records this past year. We also set

another record with the number of air travellers

moving through Charlottetown Airport in 2014. That’s

quite a milestone, and thanks needs to go again to

everyone on the ground who helped make passenger

movements as smooth and uneventful as possible. It

was pretty hectic by times with passengers travelling

for meetings and conventions, the East Coast Music

Awards and big concerts like Shania Twain and

Cavendish Beach Music Festival.

Special thanks to our airline partners who responded

to the anticipated travel demand generated by the

PEI 2014 Charlottetown Conference sesquicentennial

celebrations by adding additional seat capacity.

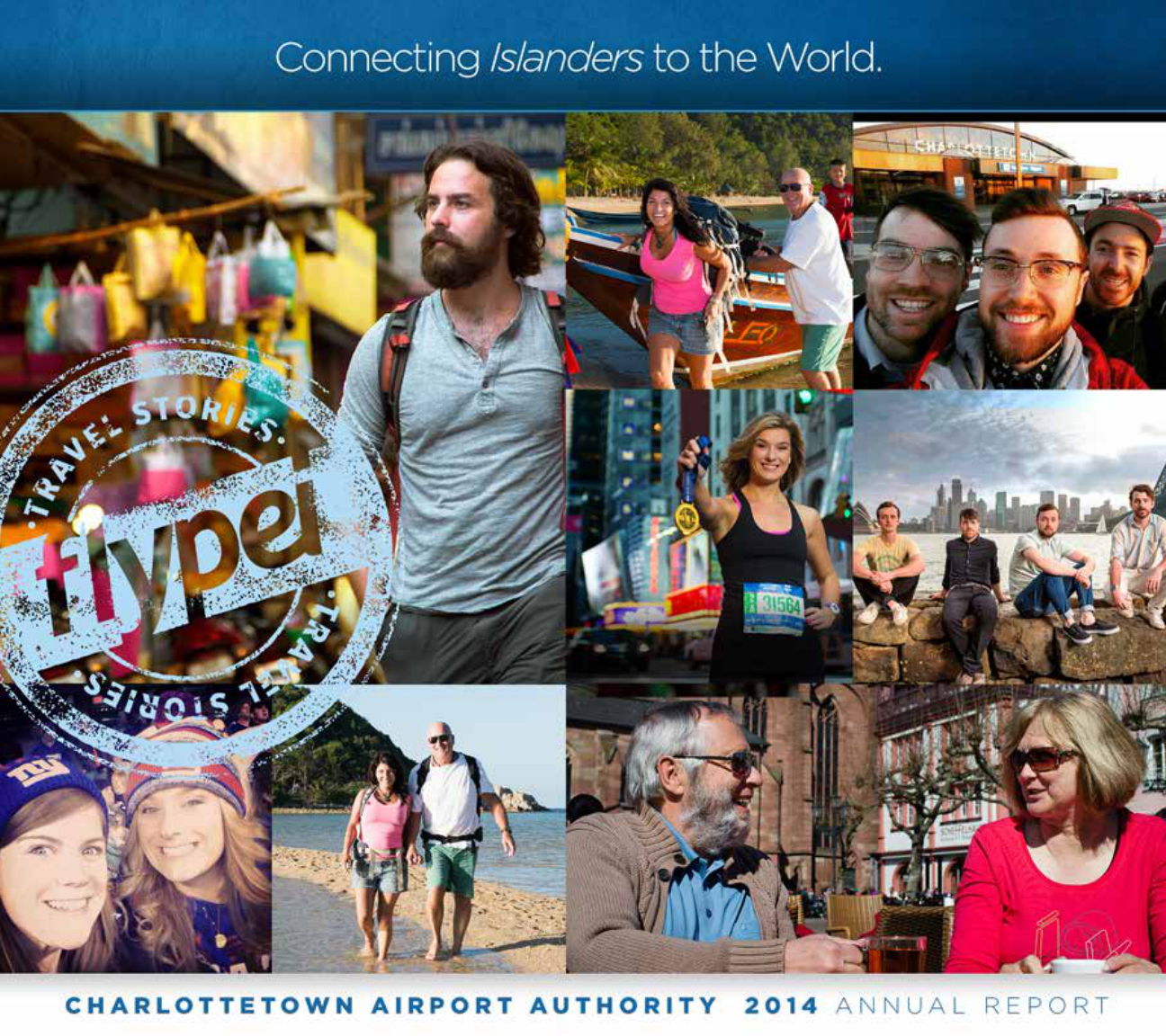

Air travel today is fast, safe and convenient. I think

that’s reflected in the individual Islanders travelling

the world who are showcased in our current

marketing campaign. As chair of The Charlottetown

Airport Authority, it is an honour to be part of a team

striving to make travel through Charlottetown Airport

even faster, safer and more convenient.

Many thanks to former board member Mike Gallant,

who completed nine years on the Airport Authority

Board this past October. Mike, your professionalism,

knowledge, counsel and contributions over the years

are appreciated. And welcome aboard to new board

member Myron MacKay. We have a strong board

with the collective knowledge and experience to set

goals and provide direction to the management of

Charlottetown Airport Authority, while allowing the

team to use their expertise and resources to deliver

results.

It is my pleasure to continue to serve as chair of the

board of directors and I look forward to continued

exciting growth and development ahead for

Charlottetown Airport.

Sincerely,

Shaun MacIsaac, Chairman

Greetings from the Chairman of the Board

and the Chief Executive Ocer

55

Chief Executive Ocer Letter

I love to travel and I love to travel from Charlottetown

because of the all-round ease and convenience of flying from

a small airport and the people that work hard every day to

accomplish this. Our Travel Stories campaign this year has

attracted a lot of attention, not only inspiring Islanders about

the wonderful global experiences possible through air travel,

but reminding Islanders that Charlottetown Airport – their

airport – is a convenient connection to the world.

We work hard to grow air access because passengers are

the lifeblood of our business. Generating passenger trac

is all about convenience, choice, eciency and friendliness.

It’s a competitive business as travellers do have options.

I’m tremendously proud of our airport team and the quality

of service oered, which is reflected in the record 317,827

passengers moving through Charlottetown Airport in 2014.

That’s the first time in the history of the airport that the

300,000 passenger movement mark has been broken.

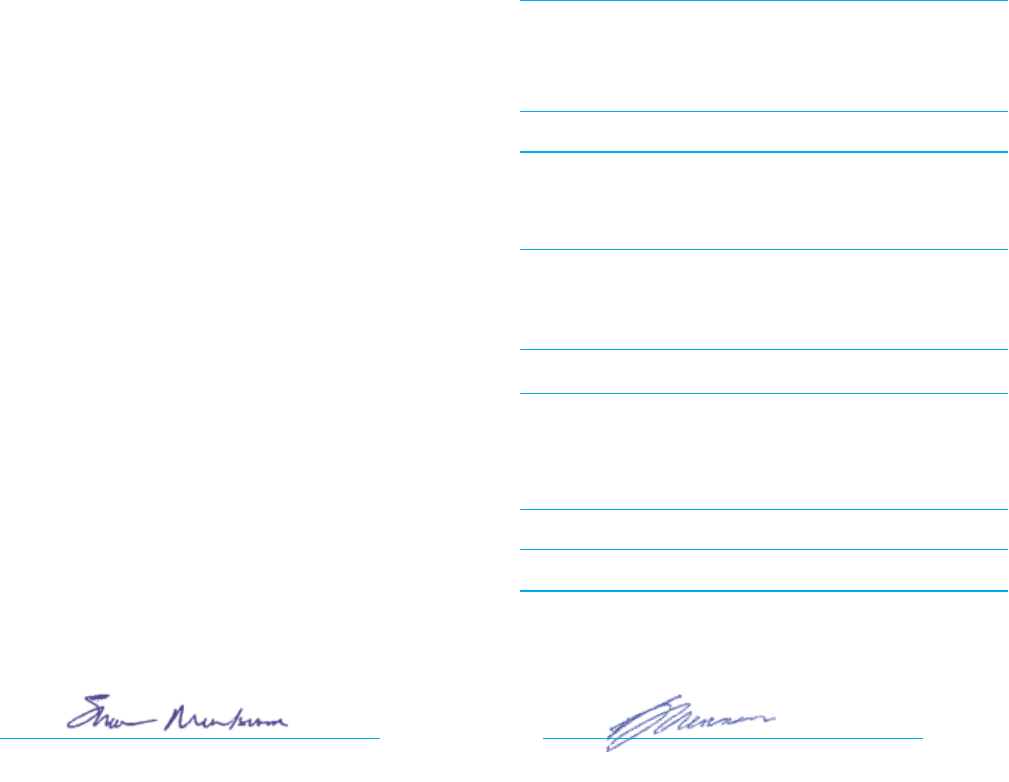

We’re also pleased that our team’s eorts are recognized

within the community. We were extremely proud to be

recognized as the Greater Charlottetown Area Chamber of

Commerce Excellence in Business Award Winner for 2014.

Charlottetown Airport is a community airport, with the

community being Prince Edward Island from tip-to-tip. We’re an

integral part of the community and we continue to build on our

commitment to support worthy community initiatives.

In 2014, the second annual flypei Runway Run in support of

Habitat for Humanity PEI was a great success. The Charlottetown

Airport team rose to the ALS ice bucket challenge as well, with

our donation going to ALS Canada in memory of former Airport

Authority board member Bob Bateman. We were also very

pleased to be a sponsor of the PEI 2014 150th Charlottetown

Conference anniversary celebrations and the East Coast Music

Awards.

While the airport did not have any major capital projects this

past year, we did invest over one million dollars in repairs,

rehabilitation and new equipment. Being diligent on maintenance

and staying ahead with asphalt crack sealing and upgrades

annually ensures that we maintain a safe airport for our airline

partners and passengers.

Once again we want to recognize the support of the City of

Charlottetown and the Province of Prince Edward Island through

grants in lieu of property tax. This support recognizes our

partners’ belief in Charlottetown Airport as an integral part of our

provincial economic engine and we would not be where we are

today without these valuable partners.

Looking ahead to the 2015 summer season we are anticipating

a slight decrease in overall seat capacity compared to 2014. Air

Canada will make slight adjustments to the extra capacity that

was added for the 2014 celebrations, but we are excited about

WestJet increasing their aircraft size for the summer season,

which helps to oset this loss in capacity.

I would like to thank our dedicated team, airline partners,

suppliers, tenants and contractors for their contribution to

another successful year at Charlottetown Airport.

Sincerely,

Doug Newson, CEO

6 Charlottetown Airport | 2014 Annual Report

7

Charlottetown Airport Authority embarked on a

business planning process in 2012 to define what

success will look like over the next five years. This

process sought input from airport stakeholders, looked

at the challenges the airport faces, and identified

opportunities for growth. Working closely with other

stakeholders and partners, we developed a new road

map for the future. The following is an outline of our

new strategic direction.

Mission

Prince Edward Island’s gateway to the world and

catalyst for economic growth.

Vision

Inspiring pride and ownership in Prince Edward Island’s

airport.

Business

Planning

Guiding Principles

Safety And Security First

We put people first and our number one priority

is the safety and security of every passenger and

employee and of our facilities.

Service Excellence

We strive to deliver positive experiences for

our passengers, tenants, partners, and other

stakeholders.

People-Oriented

We work together to foster an open and cooperative

environment that encourages professional

development, teamwork, communication, and mutual

respect.

Valued Partnerships

We value partnering with community, business, and

government for the benefit of the airport and our

province.

Results-Oriented

We strive to be innovative in our thinking and

approaches, turning challenges into opportunities

and focusing on achieving optimal results for the

airport.

Responsible Stewardship

We are transparent and accountable to all

stakeholders, managing our finances and

infrastructure prudently and continually seeking ways

to protect the environment and the future viability of

Prince Edward Island’s airport.

8 Charlottetown Airport | 2014 Annual Report8 Charlottetown Airport | 2014 Annual Report

Enhanced Air Service

GOAL 1:

Maintain existing air service and

aggressively pursue growth

Exceptional Passenger

Experience

GOAL 2:

Deliver the best small airport

experience

Engaged Island

Community

GOAL 3:

Engage the Island community in

ownership of the Airport

Sound Financial

Management

GOAL 4:

Continue the tradition of strong

financial management

Organizational Excellence

GOAL 5:

Foster a safe, healthy, and

accountable work environment

Strategic

Priorities

The Airport Authority will address the five key strategic priorities and goals for

continuing to grow the number of passengers flying to and from PEI, working towards

our vision of inspiring pride and ownership in Prince Edward Island’s airport.

9

10 Charlottetown Airport | 2014 Annual Report

11

With 317,827 passenger movements in 2014, passenger

trac was up 7.3% over 2013. It was a record year and

the first time in the airport’s history that trac numbers

surpassed the 300,000 mark.

Air Canada continues to be the main service provider

to Charlottetown Airport with daily year-round service

to Toronto, Montreal and Halifax, and seasonal non-stop

service to Ottawa. For the PEI 2014 150th celebrations, both

Air Canada and WestJet recognized the spike in demand to

travel to Prince Edward Island and added additional daily

capacity.

In 2014, WestJet provided twice daily service to Toronto

in the summer to meet the needs of the Island’s tourism

industry and then moved to three days a week in the late fall

and winter months.

Sunwing Vacations provided Islanders with the option to fly

direct from PEI for their southern vacation by oering a 13-

week service to Cayo Coco, Cuba.

Delta Air Lines continued with daily summer service non-

stop from New York City to Prince Edward Island for the

peak tourism season.

Marketing & Business Development Review

Air Service

12 Charlottetown Airport | 2014 Annual Report

13

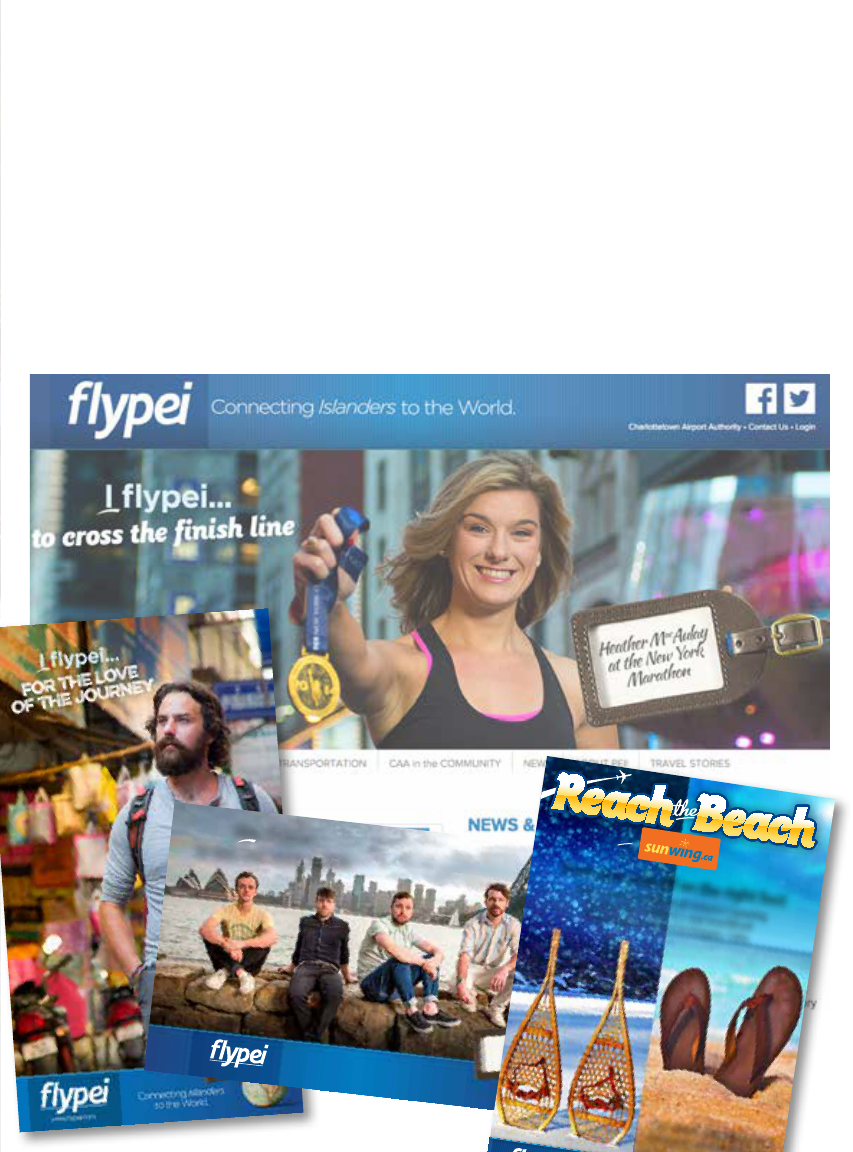

Marketing

In an eort to instill pride of ownership of our airport and encourage

Islanders to travel we must communicate the oerings we have and the

value proposition of flying from PEI.

The airport’s multi-media campaign features prominent Islanders and

frequent travellers telling why they choose to fly from PEI. This print,

online and radio advertising campaign was successful building pride in

the services our airport oers. It also raised awareness of the ease and

convenience of why people choose to fly from YYG.

Additionally, we ran two

radio promotions with our

airline partners WestJet

and Sunwing Vacations. The

WestJet promotion tied into

the PEI 2014 150th anniversary

theme of celebrating Canada

by oering a trip for two

anywhere in Canada WestJet

flies. The Sunwing Vacations trip

promotion aimed to publicize to

Islanders that they can choose

to fly from Charlottetown for

their winter southern vacations.

This is a growing travel segment

and we want to communicate

the convenience of using our

Island airport.

Both of these promotions were

successful in raising awareness

of Charlottetown Airport and

generating interest in travel.

More than 5,000 Islanders

entered contests online and we

continue to communicate with

them through our quarterly

E-traveller newsletter.

In 2014, the airport continued

to engage with the community

through social media, which

included posting messages

and interacting on the business

Facebook page and Twitter

account. The social media

audience has increased

significantly and activities have

been very successful in linking

the airport with consumers

and building on our positioning

that Charlottetown Airport is a

convenient choice for Islanders.

www.flypei.com

Connecting Islanders to the World.

Paper Lions

on tour in

Sydney, Australia

We flypei...

TO TAKE OUR SHOW GLOBAL

Connecting Islanders to the World.

www.flypei.com

w

Start your year off on the right foot

with a chance to WIN an all-inclusive Sunwing

Vacation for 2 to the 4.5-star beachfront

Playa Pesquero Resort in Holguin, Cuba.

Visit

www.sunwing.ca

to

book your sun vacation today.

Terms and conditions apply.

14 Charlottetown Airport | 2014 Annual Report

Operational Review

The Airport Authority did not undertake any major construction projects in 2014, but we did invest approximately $1.3 million in

capital upgrades, which are outlined in more detail below.

The largest spend was on the purchase of new equipment. We have been very vigilant with our fleet and equipment

replacement program over the past few years as we strive to ensure that we have the necessary tools at our disposal to

maintain a safe airport for all our of passengers and stakeholders.

One of the smaller projects that we invested in was the addition of new entry/exit signage at the airport. We are pleased

with how this project turned out as it now compliments our new and improved main access road and roundabout that was

completed in 2013.

In addition to these projects we continue to make investments in repairs and rehabilitation of some of our hard surfaces, both air

and groundside. Annually we make significant investments in asphalt and concrete crack sealing and asphalt patching. This past

year we continued our apron panel replacement program as well.

This past year also saw us purchase and implement the Vortex management system that is now being used at several Canadian

airports. This online management system is used to track safety and security incidents as well as hazard reporting while

providing real time reporting and trend analysis. As part of the Vortex software, we have added new forms on our website to

allow the public to report safety concerns and provide general customer feedback.

Summary of Capital Expenditures in 2014

Land $

Vehicles, Motor & Shop Equipment $

Chiller $

Hard Surface Rehabilitation & Repairs $

Maintenance Garage – Doors $

Signage – Main Access $

Nav Aids and Lighting $

Hangar $

Arrivals Lighting $

Entrance Mats $

Fuel Monitoring Systems $

Misc. Small Projects & Equipment $

Total $

217,868

446,785

119,415

267,096

59,800

40,038

25,745

26,416

23,610

18,218

14,864

39,180

1,299,035

15

Financial Review

Continued strong passenger demand – record setting passenger trac in fact – bolstered revenues in 2014. Record

passenger numbers also translated into increased revenues derived from concessions, including rental cars, parking

and passenger facility fees.

The early months of 2014 were challenging with a number of significant storm systems and historic amounts of snow

impacting flights. This led to increased operational costs for snow removal. Coupled with this, we had increased

maintenance and repairs on our air terminal building. These increased expenses were oset with savings over budget

on insurance, gas and diesel, salaries and depreciation.

Overall, this past year was a very successful financial year for the Airport Authority, with excess revenues of $1.9 million

being generated in 2014; a significant increase over budgeted excess revenues of $1.4 million.

Property tax grants provided by the City of Charlottetown and the Province of Prince Edward Island are greatly

appreciated and we hope to continue to work with these valuable partners to increase the economic benefits that the

airport generates for our Island economy.

2014 Actual vs. Business Plan Forecast

Plan Actual Dierence Explanation

Revenues

Expenses

Capital

8,310,441

6,857,630

1,641,000

8,766,973

6,837,225

1,299,035

456,532

20,405

341,965

Record passenger trac generated increased revenues

from concessions, parking and passenger facility fees.

Increased operational costs re: adverse winter weather and

increased maintenance and repairs ATB oset with savings

over budgeted expenses including diesel, gas, salaries,

insurance and depreciation.

Budgeted capital spend of approximately $625,000 on

natural gas was deferred. Board approved changes to

capital budget to include purchase of land, hangar and

entrance mat systems.

16 Charlottetown Airport | 2014 Annual Report

Business Plan Cash Flow Forecast 2015 – 2019

Year 2015 2016 2017 2018 2019

Revenues

Expenses

Capital

Note: Revenues includes PFF, operations, and investment income.

8,103,816

6,691,227

1,070,500

8,149,205

6,792,411

6,086,235

8,193,848

7,045,054

6,643,827

8,241,564

7,335,420

3,459,017

8,346,416

7,596,647

3,748,750

Human Resources

The 21 full-time, year round, employees of the Charlottetown Airport Authority are a dedicated and professional

group of individuals that go above and beyond the call of duty to ensure that the airport maintains a safe operation

for the travelling public and our tenants. How they handled the past few winters is a testament to the character of

the people that we employ here. Their contribution and eorts are a big reason as to as why the Airport Authority

has been so successful in recent years.

In 2014 we said goodbye to Ken Gallant, our Director of Operations. We wish Ken all the best in his future endeavors.

In August, we were fortunate to hire Shelley Christian as our new Director of Operations. Shelley brings a wealth of

experience to the team and has quickly fit in well with the sta and the airport community as a whole. Last summer

we also welcomed Andrew MacRae to our team as a Seasonal Equipment Operator. Andrew was a great addition

to the sta and we thank him, along with all our employees, for their dedication and ongoing commitment to the

Airport Authority in 2014.

17

Community Relations

In 2014, the Airport Authority held its second annual flypei Runway Run. This event has been a major success for the

airport as well as our charity of choice, Habitat for Humanity. In addition to being able to give our community the

opportunity to see our runway from a unique perspective, we are thrilled to be able to support this great cause.

Throughout each year, we also support numerous other special events and charities on Prince Edward Island. One

highlight in 2014 was being a Confederation Sponsor of the PEI 2014 anniversary celebrations. This year-long event

proved to be a great boost for air travel in 2014 and we were pleased to be able to do our part to help support their

eorts.

Other organizations that the Authority and its employees partnered with in 2014 are:

• East Coast Music Awards

• Habitat for Humanity Build Day

• Queen Elizabeth Hospital Foundation

• Prince County Hospital Foundation

• Mayors Cup Golf Tournament in support of Stars for Life

• United Way

• BBQ for Easter Seals

• COPA for Kids event held by the PEI Flying Association

• ALS Ice Bucket Challenge

18 Charlottetown Airport | 2014 Annual Report

19

The Airport Authority’s board of directors

meets six times a year with committee

meetings taking place on an ongoing basis.

The current committees of the board are:

executive, finance and audit, infrastructure

and development, human resources,

governance, and nominating.

All committees are actively involved in airport

activities, although the executive committee

is convened only when decisions are required

on an urgent basis between regularly

scheduled board meetings.

We were extremely pleased to welcome

Myron Mackay as our newest board member

in March of 2014. Myron, a nominee of the

City of Charlottetown, will be a valuable

member of our team.

We would like to acknowledge and thank

outgoing board member Mike Gallant for his

commitment to the board over the past nine

years.

Governance

20 Charlottetown Airport | 2014 Annual Report

Judy

MacDonald

Myron

MacKay

Kathryn

Coll

Paul

Kiley

George

MacDonald

Heather

Howatt

Mike

Gallant

Clair

Sudsbury

Paul

Beauregard

Kent

Scales

Shaun

MacIsaac

Robert

Sear

Susan

Ching

Shelley

Christian

Nominators’ Representatives

As of December 31, 2014

Government of Canada (2)

Shaun MacIsaac

Clair Sudsbury

Government of PEI (1)

Heather Howatt

Federation of PEI Municipalities (1)

George MacDonald

Charlottetown Airport Authority Inc (3)

Paul Beauregard

Robert Sear

Ernie Brennan

City of Charlottetown (2)

Myron MacKay

Kent Scales

City of Summerside (1)

Mike Gallant, up to October 3, 2014

Tourism Industry Association of PEI (1)

Judy MacDonald

Greater Charlottetown Area Chamber of Commerce (1)

Kathryn Coll

Chief Executive Ocer

Doug Newson

Director, Planning & Development

Jason Lindsay

Director, Finance & Administration

Susan Ching

Director, Operations

Shelley Christian

Combined salaries of the

senior management team $402,223

Board of Directors remuneration

consisting of honorariums and

per diems $56,199

Doug

Newson

Jason

Lindsay

Ernie

Brennan

21

22 Charlottetown Airport | 2014 Annual Report

Financial

Statements

Charlottetown Airport Authority Inc.

December 31, 2014

March 10, 2015

Independent Auditor’s Report

We have audited the accompanying financial

statements of Charlottetown Airport Authority Inc.,

which comprise the statement of financial position

as at December 31, 2014, and the statements of

operations, changes in net assets and cash flows for

the year then ended, and a summary of significant

accounting policies and other explanatory information.

Management’s Responsibility for the Financial

Statements

Management is responsible for the preparation and

fair presentation of these financial statements in

accordance with Canadian accounting standards for

not-for-profit organizations, and for such internal

control as management determines is necessary to

enable the preparation of financial statements that are

free from material misstatement, whether due to fraud

or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on

these financial statements based on our audit. We

conducted our audits in accordance with Canadian

generally accepted auditing standards. Those

standards require that we comply with ethical

requirements and plan and perform the audit to obtain

reasonable assurance about whether the financial

statements are free from material misstatement.

An audit involves performing procedures to obtain

audit evidence about the amounts and disclosures

in the financial statements. The procedures selected

depend on the auditor’s judgment, including the

assessment of the risks of material misstatement of

the financial statements, whether due to fraud or

error. In making those risk assessments, the auditor

considers internal control relevant to the entity’s

preparation and fair presentation of the financial

statements in order to design audit procedures that

are appropriate in the circumstances, but not for the

purpose of expressing an opinion on the eectiveness

of the entity’s nternal control. An audit also includes

evaluating the appropriateness of accounting policies

used and the reasonableness of accounting estimates

made by management, as well as evaluating the overall

presentation of the financial statements.

We believe that the audit evidence we have obtained in

our audit is sucient and appropriate to provide a

basis for our opinion.

Opinion

In our opinion, the financial statements present fairly, in

all material respects, the financial position of

Charlottetown Airport Authority Inc. as at December

31, 2014, and the results of its operations and its cash

flows for the year then ended in accordance with

Canadian accounting standards for not-for-profit

organizations.

Chartered Accountants

23

Assets

Current assets

Cash

Short-term investments (note 3)

Accounts receivable

Prepaid expenses

Long-term investments (note 3)

Capital assets (note 4)

Pension surplus (note 11)

Liabilities

Current liabilities

Accounts payable and accrued liabilities (note 6)

Security deposits

Deferred revenue

Severance pay obligation (note 10)

Deferred capital contributions (note 5)

Contingencies (note 7)

Net Assets

Invested in capital assets

Internally restricted for future requirements (note 8)

Unrestricted

Statement of Financial Position

As at December 31, 2014

Director Director

Approved by the Board of Directors

2014

$

3,064,318

6,926,801

524,305

114,991

10,630,415

2,249,000

18,274,225

327,000

31,480,640

307,037

130,034

173,043

610,114

205,487

4,628,104

5,443,705

13,646,121

12,115,280

275,534

26,036,935

31,480,640

2013

$

1,862,951

3,430,647

581,120

134,511

6,009,229

5,584,780

18,638,078

252,000

30,484,087

891,843

129,934

105,069

1,126,846

183,861

5,076,193

6,386,900

13,561,885

10,213,215

322,087

24,097,187

30,484,087

24 Charlottetown Airport | 2014 Annual Report

Net assets - Beginning of year

As previously reported 13,561,885 10,213,215 322,087 24,097,187 22,392,352

Retroactive restatement of

pension expense (note 12) - - - - 67,000

13,561,885 10,213,215 322,087 24,097,187 22,459,352

Excess revenue (expenses) for the

year (1,213,699) - 3,143,447 1,929,748 1,729,835

Pension remeasurements and other

items (notes 11 and 12) - - 10,000 10,000 (92,000)

Internally imposed restrictions

(note 8) - 3,200,000 (3,200,000) - -

Investment in capital assets, net of

related capital contributions and

proceeds of disposals 1,297,935 (1,297,935) - - -

Net assets - End of year 13,646,121 12,115,280 275,534 26,036,935 24,097,187

Statement of Changes in Net Assets

For the year ended December 31, 2014

2013

Total

$

2014

Total

$

Unrestricted

$

Restricted

for

Future

Requirements

$

Invested

in

Capital

Assets

$

25

Statement of Operations

For the year ended December 31, 2014

630,708

627,794

426,799

1,043,307

904,807

66,006

681,952

437,794

474,239

5,293,406

1,765,174

497,356

2,880,154

1,579,301

6,721,985

(1,428,579)

2,971,520

1,542,941

138,844

42,050

6,000

186,894

1,729,835

Revenue

Rentals

Concessions

Parking

Landing fees

Terminal fees

Airport services

Other income

Amortization of deferred capital contributions

Grants in lieu of property taxes (note 9)

Expenses

Salaries and benefits

Property taxes

Materials, supplies and services

Amortization

Operating loss before passenger facility fees

Passenger facility fees

Operating income

Other income

Investment income

Gain on sale of disposal of capital assets

Defined benefit pension income (notes 11 and 12)

Excess revenue for the year

2014

$

2013

$

666,929

704,976

467,161

1,025,015

903,911

79,984

669,728

448,089

478,246

5,444,039

1,780,505

506,128

2,887,704

1,662,888

6,837,225

(1,393,186)

3,152,460

1,759,274

160,374

1,100

9,000

170,474

1,929,748

26 Charlottetown Airport | 2014 Annual Report

Cash provided by (used in)

Operating activities

Net earnings for the year

Items not aecting cash

Amortization

Amortization of deferred capital contributions

Gain on disposal of capital assets

Net change in non-cash working capital items

Decrease in accounts receivable

Decrease (increase) in prepaid expenses

Increase in security deposits

Increase (decrease) in accounts payable and accrued liabilities

Increase in deferred revenue

Financing activities

Increase in severance pay obligation

Decrease (increase) in pension surplus benefit

Pension remeasurement and other items

Prior period adjustment of opening net assets

Increase in deferred capital contributions

Investing activities

Purchase of capital assets

Proceeds on disposal of capital assets

Decrease (increase) in long-term investments

Increase (decrease) in net cash

Net cash - Beginning of year

Net cash - End of year

Net cash consists of

Cash

Short-term investments

1,729,835

1,579,301

(437,794)

(42,050)

2,829,292

14,405

(11,918)

6,900

638,508

22,567

670,462

3,499,754

15,044

19,000

(92,000)

67,000

388,377

397,421

(2,009,372)

76,610

(3,415,238)

(5,348,000)

(1,450,825)

6,744,423

5,293,598

1,862,951

3,430,647

5,293,598

1,929,748

1,662,888

(448,089)

(1,100)

3,143,447

56,815

19,520

100

(584,806)

67,974

(440,397)

2,703,050

21,626

(75,000)

10,000

-

-

(43,374)

(1,299,035)

1,100

3,335,780

2,037,845

4,697,521

5,293,598

9,991,119

3,064,318

6,926,801

9,991,119

Statement of Cash Flows

For the year ended December 31, 2014

2013

$

2014

$

27

Notes to Financial Statements

December 31, 2014

1 Purpose of the organization

Charlottetown Airport Authority Inc. was incorporated without share capital under Part II of the Canada

Corporations Act in 1996. The Authority operates the Charlottetown Airport and airport business park

under a 60-year lease with the Government of Canada.

Charlottetown Airport Authority Inc. is currently exempt from federal and provincial income taxes.

2 Summary of signicant accounting policies

Basis of accounting

These financial statements have been prepared in accordance with Canadian accounting standards for

not-for-profit organizations. These financial statements include the following significant accounting

policies:

Method of accounting

Charlottetown Airport Authority Inc. follows the deferral method of accounting for contributions. Re-

stricted contributions are recognized as revenue in the year in which the related expenditures are in-

curred. Unrestricted contributions are recognized as revenue when received or receivable if the amount

to be received can be reasonably estimated and collection is reasonably assured.

Cash

Cash consists of cash on hand and bank balances.

Revenue recognition

Rental revenue arises from agricultural and commercial land leases and airline rental of space in the air

terminal building. These revenues are recognized on an accrual basis.

Concession income is recognized as earned and is primarily from licenses to vehicle rental agencies and

other concession type operations.

Parking revenue consists of fees paid for long and short term parking by travellers, car rental parking, and

employee parking, and is recognized as earned.

Landing and terminal fees are recognized upon the landing of aircraft at the airport.

Airport services revenue consists of aircraft parking fees, snow removal charges and other miscellaneous

charges to airport users, and are recognized as it is earned.

Other income consists primarily of recovered costs and is recognized in the period in which the cost

recovery occurs.

28 Charlottetown Airport | 2014 Annual Report

Deferred government contributions

Government contributions relating to the acquisition of capital assets are recorded as deferred capital

contributions. These amounts are amortized on the same basis as the related capital assets are amortized.

Government grants relating to expenses are shown as revenue in the period in which the related expenses are

incurred.

Capital assets and amortization

Purchased capital assets are recorded at cost. Contributed capital assets are recorded at fair value at the date

of contribution. Amortization of capital assets is calculated using the straight-line method. The estimated

useful life of individual assets within a category is determined upon acquisition and once it is put into use, the

asset’s cost is written o over this term as follows:

Mobile equipment 1 - 25 years

Equipment and furniture 2 - 15 years

Business park 40 years

Leasehold improvements 5 - 25 years

Use of estimates

The preparation of these financial statements in conformity with Canadian accounting standards for not-

for-profit enterprises requires management to make estimates and assumptions that aect the reported

amount of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during the current period. Significant items

subject to such estimates and assumptions include the valuation of accounts receivable, and the estimated

useful life of capital assets. Actual results could dier from those estimates.

Financial instruments

(a) Measurement of nancial instruments

Charlottetown Airport Authority Inc.’s financial instruments consist of cash, short-term investments,

accounts receivable, long-term investments, accounts payable and accrued liabilities and security

deposits.

The company initially measures its financial assets and financial liabilities at fair value adjusted by, in

the case of a financial instrument that will not be measured subsequently at fair value, the amount of

transaction costs directly attributable to the instrument. This fair value amount is then deemed to be

the amortized cost of the financial instrument.

The company subsequently measures all its financial assets and financial liabilities at amortized cost.

Investments are classified as short-term or long-term based on their individual maturity dates.

Investments with maturity dates within twelve months are classified as short-term. All other

investments are classified as long-term.

29

(b) Impairment

Financial assets measured at amortized cost are tested for impairment when there are indicators of

possible impairment. When a significant adverse change has occurred during the period in the

expected timing or amount of future cash flows from the financial asset or group of assets, a write-down

is recognized in net earnings. The write-down reflects the dierence between the carrying

amount and the higher of:

i) The present value of the cash flows expected to be generated by the asset or group of assets;

ii) The amount that could be realized by selling the asset or group of assets;

iii) The net realizable value of any collateral held to secure repayment of the asset

or group of assets.

When events occurring after the impairment confirm that a reversal is necessary, the reversal is

recognized in net earnings up to the amount of the previously recognized impairment.

(c) Risks

Transacting in financial instruments exposes the Authority to certain financial risks and uncertainties.

These risks include:

i) Credit risk: The Authority is exposed to credit risk in connection with the collection of its

accounts receivable. The Authority mitigates this risk by performing continuous evaluation

of its accounts receivables.

ii) Liquidity risk: The Authority’s exposure to liquidity risk is dependent on the collection of

accounts receivable or raising of funds to meet commitments and sustain operations. The

Authority controls liquidity risk by management of working capital, cash flows and

availability of borrowing facilities.

30 Charlottetown Airport | 2014 Annual Report

Land 217,868 - 217,868 -

Mobile equipment 4,173,163 2,364,185 1,808,978 1,631,547

Equipment and furniture 1,227,134 682,121 545,013 615,353

Business park 2,049,139 448,722 1,600,417 1,679,171

Leasehold improvements 22,122,506 8,020,557 14,101,949 14,712,007

29,789,810 11,515,585 18,274,225 18,638,078

3 Investments

Cash - investment account

Accrued interest receivable

Short term investments

(market value - $6,880,212; 2013 - $3,377,477)

Long-term investments

(market value - $2,275,486; 2013 - $5,618,003)

(maturity range August 2016 - January 2017)

Net

$

Net

$

Accumulated

amortization

$

Cost

$

2013

$

10,997

106,607

3,313,043

3,430,647

5,584,780

9,015,427

2014

$

24,185

215,311

6,687,305

6,926,801

2,249,000

9,175,801

20132014

4 Capital assets

31

Mobile equipment 1,219,089 879,382 339,707 399,369

Leasehold improvements 7,912,519 3,624,122 4,288,397 4,676,824

9,131,608 4,503,504 4,628,104 5,076,193

5 Deferred capital contributions

2013

Net

$

2014

Net

$

Accumulated

amortization

$

Cost

$

7 Commitments and contingencies

(a) Charlottetown Airport Authority Inc. is involved in a legal dispute concerning a personal injury

matter. No amount has been accrued in the records of the Authority as the outcome of the dispute is

uncertain and the amount of the liability, if any, is expected to be fully covered by insurance.

(b) Under the ground lease agreement with Transport Canada, the Authority is not required to pay rent

to the Landlord until the year 2016. At that time, rent will become payable using a formula based on

annual airport revenues.

(c) The responsibility for any liability that may arise in the future relating to the existence of hazardous

substances, originating before the transfer on March 1, 1999 to the Authority, rests with the

Government of Canada. The Authority has responsibility for any environmental liabilities that arise

from hazardous substance problems that occur subsequent to the transfer date.

2014

$

316,283

(9,246)

307,037

2013

$

863,397

28,446

891,843

6 Accounts payable and accrued liabilities

Trade

GST, HST and PST payable (receivable)

32 Charlottetown Airport | 2014 Annual Report

8 Net assets internally restricted for future requirements

Eective December 31, 2014, the Board authorized the transfer of $3,200,000 (2013 - $2,700,000) from

unrestricted net assets to internally restricted net assets. The internal restrictions set by the Board allow

transfers from this fund only for authorized purposes including the purchase of capital assets.

9 Grants in lieu of property taxes

The Province of Prince Edward Island and the City of Charlottetown provide the Authority annually with

grants in lieu of property taxes. The granted amount of $478,246 for the year ended December 31, 2014

(2013 - $474,239) is included as revenue in these financial statements.

10 Severance pay obligation

Employees are entitled to severance pay under the terms of a collective agreement and management

contracts. The severance pay obligation is accrued by the Authority commencing with an individual’s

employment.

11 Pension plan

Charlottetown Airport Authority Inc. is a member of the Canadian Airport Authorities and Canadian Port

Authorities Pension Plan (the “Plan”), a multiple employer pension plan. The Plan includes both a defined

benefit portion (“Superannuation Plan”) and a defined contribution portion (“Defined Contribution Plan”).

Employees who were previously employed by Transport Canada automatically became members of the

Superannuation Plan on March 1, 1999 when control of the Charlottetown airport was transferred to

Charlottetown Airport Authority Inc. The Superannuation Plan was closed to new members subsequent

to that date, and all other employees of the Authority are members of the Defined Contribution Plan.

Eligible employees contribute to the Superannuation Plan each year at the rate of 7.5% of earnings up to

$3,500, 4.0% of earnings between $3,500 and $52,500 and 7.5% of earnings above $52,500. The

Authority is required to make annual contributions to the Superannuation Plan as advised by the

actuaries.

Employees who are members of the Defined Contribution Plan contribute up to 6% of earnings, while the

Authority matches 100% of employees’ contributions. Pension expense for the Defined Contribution

Plan was $72,214 for 2014 (2013 - $66,937), and is included in salaries and benefits in the Statement of

Operations.

33

Valuation information on the Superannuation Plan for the year ended December 31, 2014 is provided by

the Plan’s actuary, AON Consulting Inc., from their most recent actuarial valuation of the Plan, completed

as of June 2014 and extrapolated to December 31, 2014.

Significant assumptions used by the Plan’s actuary for this valuation are:

2014 2013

Discount rate 5.50% 5.50%

Salary escalation rate 3.00% 4.00%

Indexation rate 2.50% 2.50%

34 Charlottetown Airport | 2014 Annual Report

Superannuation Plan - Actuarial valuation information

Defined benefit plan assets

Fair value of plan assets -

Balance - beginning of year

Expected return on assets

Charlottetown Airport Authority Inc. contributions

Employee contributions

Benefits paid

Actuarial gain on plan assets

Balance - end of year

Defined benefit plan obligations

Accrued benefit obligation -

Liabilities - beginning of year

Current service cost

Interest cost

Benefits paid

Actuarial losses

Balance - end of year

Reconciliation of the funded status of the Superannuation

Plan to the amount recorded in the financial statements

Fair value of the plan assets

Accrued benefit obligation

Accrued benefit asset

Accrued benefit asset - beginning of year

Defined benefit pension income for the year (note 12)

Pension remeasurement and other items (note 12)

Charlottetown Airport Authority Inc. contributions (note 12)

Accrued benefit asset per financial statements - end of year

1,076,000

62,000

67,000

2,000

(54,000)

80,000

1,233,000

805,000

13,000

45,000

(54,000)

172,000

981,000

1,233,000

981,000

252,000

271,000

6,000

(92,000)

67,000

252,000

1,233,000

68,000

56,000

3,000

(51,000)

51,000

1,360,000

981,000

10,000

52,000

(51,000)

41,000

1,033,000

1,360,000

1,033,000

327,000

252,000

9,000

10,000

56,000

327,000

2014

$

2013

$

The following information is calculated by the Plan’s actuary in accordance with Accounting Standards

for Private Enterprises:

35

12 Prior period adjustment

On January 1, 2014, measurement and disclosure standards for employer future benefits changed

under Canadian Accounting Standards for not-for-profit organizations. This required retroactive

restatement of 2013 pension costs as follows: pension cost, previously reported as $19,000 on the

2013 Statement of Operation was adjusted to pension income of $6,000, increasing excess revenue

for 2013 by $25,000 to $1,729,835; pension remeasurement and other items, previously reported

as nil on the 2013 Statement of Changes in Net Assets was adjusted to $(92,000); and opening

net assets, previously reported as $22,392,352 on the 2013 Statement of Changes in Net Assets,

was adjusted by $67,000 to $22,459,352. These restated 2013 numbers were provided by the

Superannuation Plan’s actuary.

Charlottetown Airport Authority

250 Maple Hills Avenue, Suite 132

Charlottetown, PE

C1C 1N2